- #Personal financial planning worksheets how to

- #Personal financial planning worksheets full

- #Personal financial planning worksheets download

- #Personal financial planning worksheets free

Some of the options listed also present schemes for dealing with your loans, a multiple credit card payoff calculator, and recommendations for paying down other debt.

#Personal financial planning worksheets download

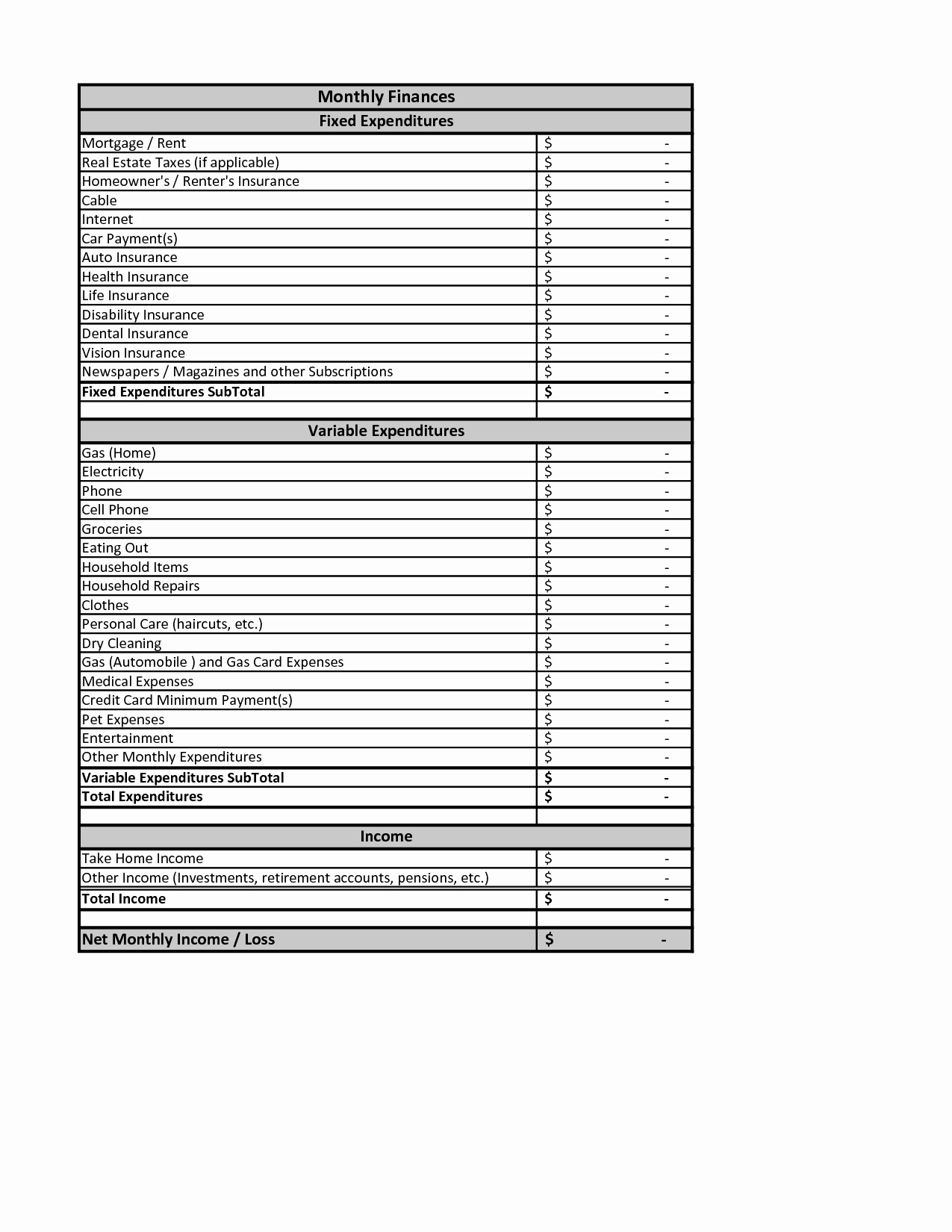

All you need to do is download the template and plug in a few numbers-the spreadsheet will do all the math. With a template, you get a ready-made spreadsheet with the right formulas to do all of the calculating for you.

Technically, these are spreadsheet templates that you can use with Microsoft Excel, OpenOffice Calc, or Google Sheets. No matter your age or education, you need to be in control of your financial matters. You are in control of your financial future, and every choice you make can have an impact.

#Personal financial planning worksheets how to

One option on this list even walks you through how to choose a debt-payoff method by comparing the snowball method to the avalanche method and other strategies. The first step on the path to financial success is accepting responsibility. The snowball method is a popular strategy, and downloading one of these debt-snowball spreadsheets can help you reduce your debt. 15 Personal Finance Excel Spreadsheet Templates for Managing Money. But spreadsheets simplify the task, making it easy for anyone who can use a spreadsheet to make a plan to pay off debt. For complete and current information on any product, please visit the provider’s website.Coming up with a plan for paying off debt may sound difficult, especially if you don’t have a financial background. excel sheet for personal finance can help you with understanding your financial.

#Personal financial planning worksheets free

Product information and details vary for Quebec. Free Excel templates to manage your personal finances, budgeting. Be sure to review the provider’s terms and conditions for all products and services displayed on MoneySense.ca. Our financial worksheets help you set up a budget, establish goals you can live with, track spending and determine your true net worth. Better budgeting and sound money management starts with a plan. Our Advertisers/partners are also not responsible for the accuracy of the information on our site. Use these worksheets to help you manage your financial life and begin your savings fitness plan. This budget template enables you to: work out where your money is going create your own custom items change the currency. Manage Your Money Better with Financial Worksheets.

Advertisers/partners are not responsible for and do not influence any of the editorial content appearing on MoneySense.ca. The content provided on our site is for information only it is not meant to be relied on or used in lieu of advice from a professional.

#Personal financial planning worksheets full

MoneySense aims to be transparent when we receive compensation for advertisements and links on our site (read our full advertising disclosure for more details). MoneySense is not responsible for content on external sites that we may link to in articles. If you read something you feel is incorrect or misleading, we would love to hear from you. Use this worksheet to compile important facts about your financial life, such as account numbers and contact. Create a financial plan that will handle your personal finance requirements and objectives in the future to help you stay organized, on track, and occupied. While our editorial team does its best to ensure accuracy, details change and mistakes happen. Download the Personal Finance Cheat Sheet. While our goal is to provide accurate and up-to-date financial content, we encourage readers to practice critical thinking and cross-reference information with their own sources-especially before making any financial decisions. MoneySense is owned by Ratehub Inc., but remains editorially independent. MoneySense is a digital magazine and financial media website, featuring content produced by journalists and qualified financial professionals.

0 kommentar(er)

0 kommentar(er)